If you make your monthly payment exactly on your due date, you'll pay the specific quantity of interest that you had initially prepared. Nevertheless, if you make a payment prior to your due date, less interest will accumulate, so more of your fixed payment will go towards the principal. On the other hand, if you make your payment late, more interest will accumulate, so http://tysonyyif054.theburnward.com/why-are-most-personal-loans-much-smaller-than-mortgages-and-home-equity-loans-things-to-know-before-you-buy more of your payment will go towards interest and less towards principal.

9% Fixed monthly payment is $386 Your everyday financing charge would be computed as follows: ($ 20,000 x 5. 9%)/ 365 days each year = $3. 23/day If your $386 payment is received exactly one month from the date of your last payment, your finance charge for that duration would be $96.

23 x 30 days). Your $386 payment would be divided in between principal and the finance charge: Principal: $289. 10 Finance Charge: $96. 90 Total: $386. 00 If you make your next payment precisely 1 month later, the primary quantity would be greater and the financing charge would be lower. If you have extra concerns, please contact our Loan Department at (800) 749-9732 ext.

If you're going to be responsible for paying a home mortgage for the next 30 years, you should understand exactly what a home mortgage Click to find out more is. A home loan has three fundamental parts: a deposit, monthly payments and fees. Considering that mortgages typically include a long-term payment plan, it is essential to comprehend how they work.

is the quantity required to settle the mortgage over the length of the loan and includes a payment on the principal of the loan as well as interest. There are typically real estate tax and other fees included in the month-to-month expense. are different costs you have to pay up front to get the loan.

Getting The There Are Homeless People Who Cant Pay There Mortgages To Work

The larger your down payment, the much better your financing deal will be. You'll get a lower mortgage interest rate, pay less fees and gain equity in your house more rapidly. Have a great deal of questions about mortgages? Inspect out the Consumer Financial Security Bureau's responses to often asked concerns. There are two main types of home mortgages: a standard loan, ensured by a personal lending institution or banking organization and a government-backed loan.

This eliminates the requirement for a deposit and also prevents the requirement for PMI (private home mortgage insurance coverage) requirements. There are programs that will assist you in getting and funding a home mortgage. Contact your bank, city advancement workplace or an experienced property agent to discover more. Many government-backed home mortgages can be found in among 3 forms: The U.S.

The initial step to get a VA loan is to obtain a certificate of eligibility, then submit it with your newest discharge or separation release papers to a VA eligibility center. The FHA was produced to assist people acquire cost effective real estate Have a peek at this website (blank have criminal content when hacking regarding mortgages). FHA loans are really made by a financing organization, such as a bank, but the federal government guarantees the loan.

Backed by the U.S. Department of Farming, USDA loans are for rural property buyers who lack "decent, safe and sanitary housing," are unable to secure a mortgage from standard sources and have an adjusted earnings at or below the low-income limit for the location where they live. After you select your loan, you'll decide whether you want a fixed or an adjustable rate.

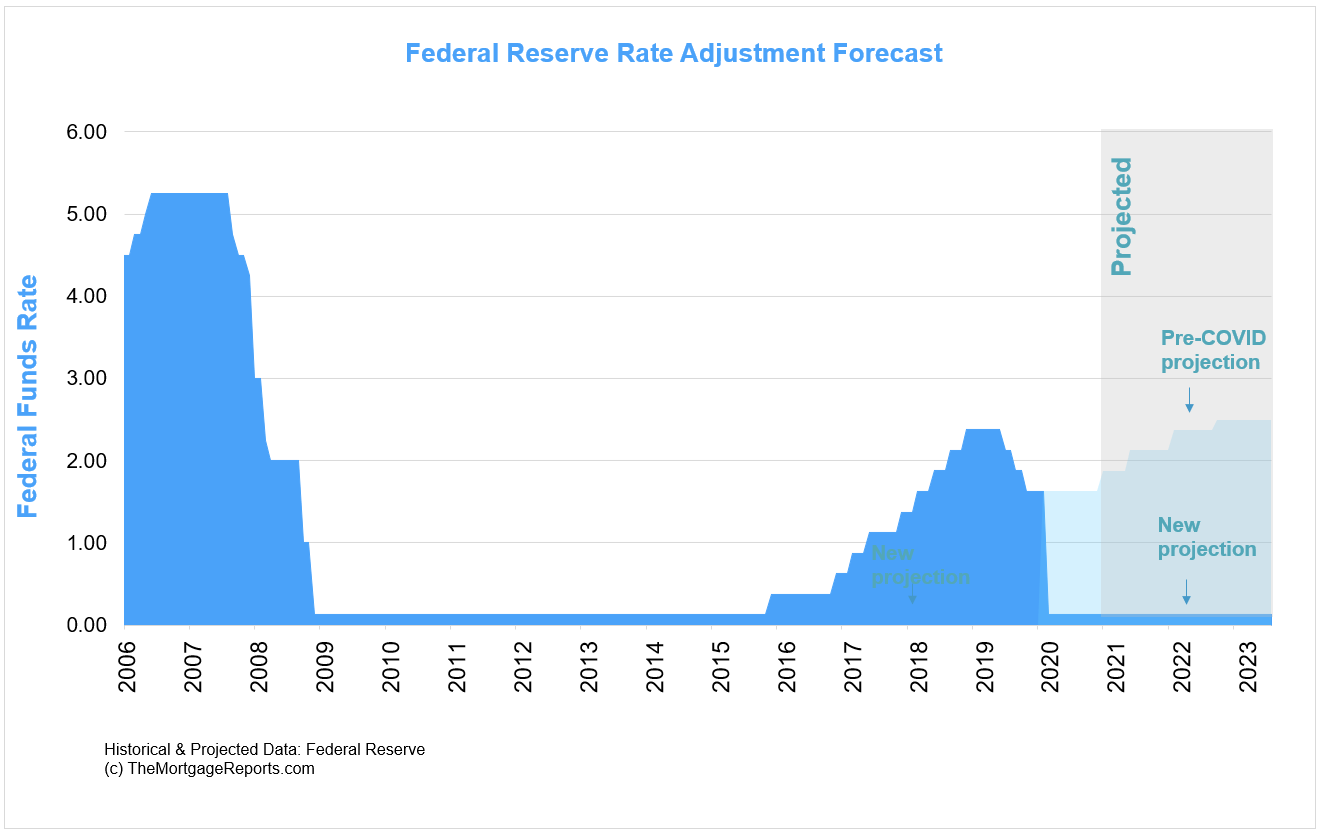

A fixed rate home loan requires a monthly payment that is the exact same quantity throughout the regard to the loan. When you sign the loan papers, you settle on an interest rate and that rate never ever alters. This is the very best type of loan if rate of interest are low when you get a home loan.

Getting The Which Mortgages Have The Hifhest Right To Payment' To Work

If rates increase, so will your mortgage rate and monthly payment. If rates increase a lot, you might be in big trouble. If rates go down, your home loan rate will drop therefore will your regular monthly payment. It is normally most safe to stick to a set rate loan to safeguard against rising interest rates.

The quantity of money you borrow affects your rate of interest. Home mortgage sizes fall under two primary size classifications: adhering and nonconforming. Conforming loans meet the loan limitation standards set by government-sponsored home mortgage associations Fannie Mae and Freddie Mac. Non-conforming loans consist of those made to customers with bad credit, high debt or current insolvencies.

If you want a home that's priced above your regional limit, you can still get approved for an adhering loan if you have a big enough deposit to bring the loan amount down below the limitation. You can reduce the rate of interest on your mortgage loan by paying an up-front charge, called home mortgage points, which subsequently minimize your month-to-month payment.

125 percent. In this way, buying points is stated to be "buying down the rate." Points can likewise be tax-deductible if the purchase is for your primary home. If you plan on living in your next home for at least a years, then points may be an excellent option for you.

Within three days after receiving your loan application, a mortgage supplier is needed to give you a good-faith quote (GFE) that details all the charges, charges and terms associated with your mortgage. Your GFE likewise includes a quote of the overall you can expect to pay when you close on your house.

The Best Guide To What Is The Going Rate On 20 Year Mortgages In Kentucky

If your loan is rejected within three days, then you are not ensured a GFE, but you do deserve to ask for and receive the specific factors your loan was denied. The rate of interest that you are estimated at the time of your home mortgage application can change by the time you sign your house loan.

This assurance of a set rates of interest on a mortgage is just possible if a loan is closed in a specified period, normally 30 to 60 days. The longer you keep your rate lock past 60 days, the more it will cost you. Rate locks can be found in various forms a percentage of your mortgage amount, a flat one-time charge, or merely an amount figured into your interest rate.

While rate locks normally avoid your rate of interest from rising, they can also keep it from decreasing. You can look for out loans that provide a "float down" policy where your rate can fall with the marketplace, however not rise. A rate lock is worthwhile if an unexpected boost in the rates of interest will put your home mortgage out of reach.

The PMI safeguards the lender's liability if you default, permitting them to issue home loans to somebody with lower down payments. The cost of PMI is based upon the size of the loan you are looking for, your down payment and your credit rating. For example, if you put down 5 percent to buy a home, PMI may cover the additional 15 percent.

As soon as your mortgage principal balance is less than 80 percent of the original appraised value or the existing market value of your house, whichever is less, you can generally cancel the PMI. Your PMI can also end if you reach the midpoint of your reward for instance, if you secure a 30-year loan and you complete 15 years of payments.